2025 Rare Earth Mining Investment Guide

Shirley

Shirley

Aug 25, 2022

Aug 25, 2022

891

891

If you want to know more details about equipment, solutions, etc, please click the button below for free consultation, or leave your requirements!

(Rare earth mine)

Rare earth elements, also known as rare earth metals or rare earth oxides, or lanthanides, are a group of 17 silver-white soft heavy metals. Rare earth metals are actually abundant in the Earth's crust. However, they are rarely found alone in large concentrated deposits, but are found in other elements.

01 Rare Earth Use

BackMost rare earth elements are used as catalysts and magnets in conventional and low carbon technologies. Other important uses of rare earth elements are in the production of specialty metal alloys, glass and high-performance electronics. The strongest known magnets are neodymium alloys with iron and boron. Adding other rare earth elements such as dysprosium and praseodymium can change the properties and properties of the magnet. These magnets and components are required in hybrid and electric vehicle engines, generators in wind turbines, hard drives, portable electronics and cell phones. This role in technology has brought their mining and refining into the focus of many countries.

02 Rare Earth Species

BackLight and heavy rare earth metals are widely used and play a vital role in the manufacture of electronic products.

Light rare earth metals

All rare earth metals are part of a chemical group called the lanthanides, and light rare earths represent the lanthanides with the lowest atomic number. Light rare earths are cerium, lanthanum, praseodymium, neodymium, promethium, europium, gadolinium and samarium.

Among the light rare earth metals, neodymium is considered to be one of the most critical metals. It is used in everything from cell phones and electric vehicles to medical devices. Neodymium is also the main light rare earth used to make permanent magnets, which are used in large quantities in data storage systems and wind turbines.

Heavy rare earth metals

Heavy rare earth metals are defined by their higher atomic weight relative to light rare earths. They are less common and some elements in the group are facing shortages as demand outstrips supply. This generally makes them more valuable than light rare earths, although they also have a smaller market. The full list of heavy rare earths is dysprosium, yttrium, terbium, holmium, erbium, thulium, ytterbium, yttrium, and lutetium.

03 Global Rare Earth Production

BackThe total reserves of rare earths in the world amount to 120 million tons. Demand for rare earth minerals continues to rise as the mining industry continues to hype electric vehicles and other high-tech products. Rare earth metal production rose again in 2021, with global production jumping to 280,000 metric tons (MT), up from 190,000 metric tons in 2018.

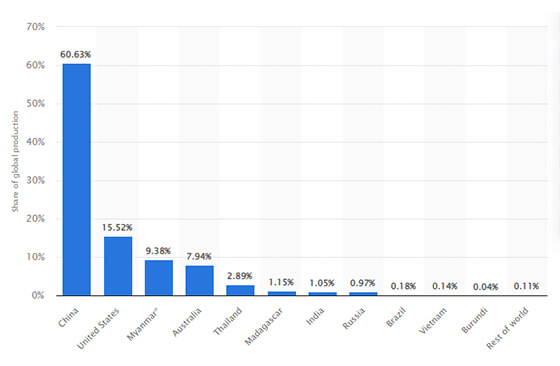

Here are the 10 countries that will mine the most rare earths in 2021 (updated in 2022), according to the latest data from the U.S. Geological Survey.

01 China -- 168,000 tons

China has dominated rare earth production for quite some time. In 2021, domestic production will be 168,000 tons, up from 140,000 tons in the previous year. The rare earth industry is mainly in charge of six state-owned mining companies.

02 USA -- 43,000 tons

The US produced 43,000 tons of rare earths in 2021, up from 39,000 tons the year before. U.S. rare earth supply currently only comes from the Mountain Pass mine in California, which resumed production in the first quarter of 2018 following care and maintenance in the fourth quarter of 2015. It was run by Molycorp before bankruptcy and then by MP Mine Operation, now MP Materials.

03 Myanmar -- 26,000 tons

Myanmar mined 26,000 tons of rare earths in 2021, down from 31,000 tons the previous year. A 2021 military coup in Myanmar has raised concerns that these rare earth imports could be cut off, but so far there have been few trade disruptions.

04 Australia -- 22,000 tons

Rare earth production in Australia has been rising steadily over the past few years. However, its production rose slightly to 22,000 tons in 2021, up from 21,000 tons in 2020. The country has the world's sixth-largest reserves of rare earths and is poised to increase its production.

05 Thailand -- 8,000 tons

Rare earth production in Thailand more than doubled from 3,600 tons in 2020 to 8,000 tons in 2021. Its rare earth reserves are currently unknown, but the country remains a top 10 producer of rare earth metals.

06 Madagascar -- 3,200 tons

Madagascar recorded 3,200 tons of rare earths mining in 2021, up from 2,800 tons the year before. It owns the Tantalus rare earth project, which is said to contain 562,000 tons of rare earth oxides.

07 India -- 2,900 tons

India's 2021 production of just 2,900 tons is unchanged from the previous year and accounts for about 1% of global rare earth supply. Rare earth production in India is well below its potential, considering the country is home to nearly 35 percent of the world's beach sand deposits, which are a significant source of rare earths.

08 Russia -- 2,700 tons

Russia produced 2,700 tons of rare earths in 2021, the same as the previous three years. Russia has reportedly cut mining taxes and offered discounted loans to investors in nearly a dozen projects aimed at boosting the country’s share of global rare earth production to 10% by 2030 from the current 1.3%.

09 Brazil -- 500 tons

Madagascar recorded 3,200 tons of rare earths mining in 2021, up from 2,800 tons the year before. It owns the Tantalus rare earth project, which is said to contain 562,000 tons of rare earth oxides.

10 Vietnam -- 400 tons

Rare earth production in Vietnam will drop from 700 tons in 2020 to 400 tons in 2021. According to reports, the country has several deposits of rare earth materials, concentrated along the northwest border and eastern coastline with China.

(Share of rare earth global production)

04 Rare Earth Metal Market

BackIn 2020, China produced the most rare earth metals at 140,000 metric tons (MT). The second largest producer is the United States with only 38,000 tons. High volumes, low labor costs and lax environmental regulations allow China to control the pricing and market viability of rare earth metals.

The semi-annual rare earth mining quota in 2021 is 84,000 tons (a year-on-year increase of 27.2%), and the smelting and separation quota is 81,000 tons (a year-on-year increase of 27.6%). This system effectively led China to become the world's largest importer of rare earths in 2018.

05 Rare Earth Investment Pattern

BackGlobal demand for rare earths is expected to increase as the clean energy, electric vehicle and consumer electronics industries become more important.

Even if regulations and demand create a more favorable environment for rare earths, investors should be clear about their research on metals - treating the rare earth category as a single category, and even treating the rare earth category as light and heavy is not an element provide sufficient background information on the investment potential.

06 Rare Earth Investment Methods

BackSupply and demand

On the demand side, many analysts believe that demand for rare earths will surge starting in 2021 as growth rates accelerate in top end-use categories, including the electric vehicle market and other high-tech applications.

For example, dysprosium is a key material in steel manufacturing and laser production, and demand for dysprosium is growing as countries raise steel standards. In addition to this, rare earth raw materials have long been used in televisions and rechargeable batteries, two industries that accounted for the majority of the rare earth market before the new technology spread.

Other rare earth metals are used in wind turbines, aluminum production, catalytic converters and many high-tech products used every day.

Securing rare earth supplies is an increasingly important issue. In addition to traditional rare earth mining, there has also been growth in the rare earth recycling industry, which aims to recover REE raw materials from electronics and high-tech products so that they can be reused in new ways.

Prospecting and extracting rare earth materials from deep-sea mud is one of the newest recycling methods and is gaining traction as more and more mining companies seek resources offshore.

Investment method

The most strategic and direct way to invest in the rare earth industry is through mining and exploration companies. Although many of these companies are located in China and are not publicly traded, there are some companies that are accessible. Below are some rare earth-focused companies traded on the TSXV, TSX and ASX. All with market capitalizations in excess of $50 million as of July 21, 2021.

Alkane Resources

Greenland Minerals and Energy

Mkango Resources

Key Metals in Namibia

Some small REE companies are also listed on these exchanges. Below is a list of TSXV, TSX and ASX-listed rare earth companies with market capitalizations below $50 million as of July 21, 2021:

Avalon Advanced Materials

Canadian Rare Earths

Gambier Gold

Business resources

Defense metal

GeoMegA Resources

07To Wrap Up

BackThe above introduce how to invest in rare earth. Before we also introduce the cobalt mining investment guide and lithium mining investment guide. If you have other questions, please leave your message or contact the online service, we will contact you soon.

+86 182 3440 3483

+86 182 3440 3483 yanzhang19990421@gmail.com

yanzhang19990421@gmail.com

Message

Message Chat Now

Chat Now