2025 Lithium Mining Investment Guide

Shirley

Shirley

Jul 05, 2022

Jul 05, 2022

2005

2005

If you want to know more details about equipment, solutions, etc, please click the button below for free consultation, or leave your requirements!

Lithium is the lightest element of all metals. It is widely used in air handling, batteries, ceramics, glass, metallurgy, pharmaceuticals and polymers. Rechargeable lithium-ion batteries are especially important in the fight against global warming, as they can power cars and trucks using renewable energy sources such as hydro, solar or wind.

We have already introduced the cobalt mining investment guide. Now we will introduce the lithium mining investment guide.

01 Types of Lithium Deposits

BackLithium deposits can be roughly divided into six categories, namely lithium-cesium-tantalum pegmatite deposits, lithium-rich granite, lithium salt deposits in closed basins, lithium in other brines, lithium clay deposits, and lithium zeolite deposits.

(1) Lithium-cesium-tantalum pegmatite deposits

Lithium-cesium-tantalum pegmatites are found in the hinterland of metamorphic igneous rocks in orogenic belts and are the result of plate convergence. Most lithium-cesium-tantalum pegmatites form during collisions between continents or microcontinents and are associated with aluminum-rich granites from the melting of metamorphic sedimentary rocks.

(2) Lithium-rich granite

Some muscovite-bearing granites include regions rich in lithium, tantalum, tin, and fluorine. Lithium-rich granites are closely related to LCT pegmatites and have not been distinguished from each other in recent global lithium resource assessments.

(3) Lithium salt deposits in closed basins

Closed basin brine deposits are estimated to account for 58% of the world's proven lithium resources. Lithium brine deposits are accumulations of saline groundwater rich in dissolved lithium. Lithium deposits in production have average lithium concentrations ranging from 160 to 1,400 ppm, with estimated lithium resources ranging from 0.3 to 6.3 million tons.

(4) Lithium in other brines

Deep oil field brines can contain as much as several hundred parts per million lithium. In some places, lithium levels in brine can be as high as 692 milligrams per liter (mg/L). The brine occupies the pore space of limestone about 200 meters thick at depths between 1,800 and 4,800 meters.

(5) Lithium clay deposits

A small fraction of the world's clay deposits are rich in lithium. Lithium-bearing clay deposits account for about 7% of the world's lithium resources. Lithium clays are present in hydrothermally altered sediments in crater lakes.

(6) Lithium zeolite deposits

The only documented lithium zeolite deposits are from the Neogene basin system in the Balkans of Eastern Europe. The Miocene lakebed in the Jadar Basin includes oil shale, carbonate, evaporite, and tuff. These formations are spontaneously grown with abundant layers of jdarite, a recently recognized boron-lithium silicate mineral of the zeolite family.

02 Top 10 Lithium Mines in the World

BackWestern Australia is home to five of the world's largest lithium mines with combined reserves of more than 475.24 million tonnes (Mt). Mining Technology has ranked the top ten lithium mines in the world based on proven and probable reserves.

Sonora Lithium Project - 243.8Mt

Thacker Pass Lithium Project - 179.4Mt

Wodgina Lithium Project - 151.94Mt

Pilgangoora Lithium Project - 108.2Mt

Earl Gray Lithium Project - 94.2Mt

Greenbushes Lithium Project - 86.4Mt

Whabouchi Lithium Project - 36.6Mt

Pilgangoora Lithium Project - 34.2Mt

Goulamina Lithium Project - 31.2Mt

Arcadia Lithium Project - 26.9Mt

03 The 9 Countries with Largest Lithium Reserves

BackLithium, a key component of batteries and other electronics, is becoming more common around the world, especially rechargeable lithium-ion batteries used in electric vehicle manufacturing and large-scale battery storage. With these manufacturing trends expected to accelerate in the coming years as the energy transition accelerates, interest in this silver-white metal will continue to grow. Analysts expect global demand to more than double by 2024.

Here's how the U.S. Geological Survey (USGS) ranks countries with lithium reserves:

.png)

(Global lithium reserves by 2021, by country (in 1,000 metric tons))

Chile - 9,200,000 metric tons

Australia - 5,700,000 metric tons

Argentina - 2,200,000 metric tons

China - 1,500,000 metric tons

United States — 750,000 metric tons

Canada — 530,000 metric tons

Zimbabwe - 220,000 metric tons

Brazil - 95,000 metric tons

Portugal — 60,000 metric tons

04 Major Global Lithium Producers in 2021

BackLithium has become a key resource with applications ranging from pharmaceuticals to electronic components. Today, the metal's primary end use is in lithium-ion batteries, used in portable electronics and electric vehicles. Global lithium mine production has grown significantly over the past decade, and demand is expected to continue to grow in the coming years.

Australia leads the world in lithium mine production with an estimated 55,000 metric tonnes in 2021. Chile and China ranked second and third with lithium production of 26,000 and 14,000 metric tons, respectively.

.png)

(Major countries in global lithium production in 2021 (metric tons))

Australia has the world's largest hard rock lithium mine, mainly extracting alkali metals from spodumene. Chile's lithium production, on the other hand, comes from brine pumped from below the surface into evaporation ponds in Chile's Atacama Desert. Chile accounts for a significant portion of global lithium reserves due to the Atacama's lithium-rich brine deposits. While China is one of the world's leading producers of lithium, it is also a major consumer of the metal.

05 The 7 Largest Lithium Mining Companies in 2022

Back(1) Jiangxi Ganfeng Lithium

Jiangxi Ganfeng Lithium is a major lithium producer in China with a market capitalization of $32.89 billion. It is the largest producer of lithium compounds in China and one of the largest lithium metal producers in the world in terms of capacity.

The mining company has lithium deposits around the world, including in Australia, Argentina, China and Ireland. But its main source of lithium is Mount Marion in Western Australia.

(2) Tianqi Lithium

Lithium producer Tianqi Lithium, a subsidiary of Chengdu Tianqi Industry Group, is based in China and is the world's largest producer of hard rock lithium with a market value of $23.03 billion. The company has assets in Australia, Chile and China.

(3) Albemarle

Albemarle is one of the largest lithium producers in the world, with a market capitalization of $22.47 billion and 5,000 employees and customers in 100 different countries. In addition to lithium, Albemarle produces bromine and provides refining solutions and chemical services to pharmaceutical companies.

(4) Sociedad Quimica y Minera de Chile S.A

Sociedad Quimica y Minera de Chile S.A claims to be a leader in lithium and derivatives with a 19% market share, with offices in more than 20 countries and customers in 110 countries worldwide. The company has five businesses, from lithium to potassium to specialty plant nutrition, and has a market capitalization of about $19.98 billion.

(5) Pilbara Minerals

Australian-listed Pilbara Minerals, which operates its 100 per cent owned Pilgangoora lithium tantalum assets in Western Australia, has a market capitalisation of $5.89bn. The business consists of two processing plants: the Pilgan plant, located on the north side of the Pilgangoora area, which produces spodumene concentrate and tantalum. And the Ngungaju plant in the south, which produces spodumene concentrate.

(6) Allkem

Allkem, formed from the A$4 billion merger of Argentina's Orocobre and Australia's Galaxy Resources, has a market capitalisation of US$4.17 billion. Headquartered in Buenos Aires, Argentina, Allkem is an industrial chemicals and mining company operating a portfolio of lithium, potash and boron projects and facilities in the Pune region of northern Argentina.

(7) Livent

Livent, which was spun out from FMC in 2018, employs more than 900 people worldwide and has manufacturing facilities in the US, UK, India, China and Argentina. The company has a $3.73 billion lithium business in Salar del Hombre Muerto, Argentina, where it has been extracting lithium for more than 20 years. The lithium carbonate produced is used as a feedstock for Livent's downstream lithium hydroxide production. Livent also currently produces qualified battery-grade lithium hydroxide in the United States and China.

06 Lithium Resource Market Status

BackLithium is a soft, silver-white alkali metal with high reactivity and low density. Although it has had a variety of applications throughout history, in recent years it has become a key component of lithium-ion (Li-ion) batteries due to its reactivity, portability, and rechargeability.

(1) Lithium and Batteries

One of the most well-known end uses of lithium is in lithium-ion batteries. Lithium-ion batteries are rechargeable and are mainly used in portable electronics and electric vehicles. Policy and consumer sentiment are driving exponential EV adoption as global auto companies respond. In December 2021, China's monthly EV sales hit a new record of 502,545 units, up 125% since January 2020. BMW continues its rapid electrification, delivering 97,000 plug-in electric vehicles in the fourth quarter of 2021 (up 29.6% year-on-year).

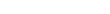

(Forecast Electric Vehicle Sales)

The chart above shows the projected growth in global EV sales through 2025. An estimated 17.6 pounds of lithium is required for battery cathodes in standard-model EVs, so potential lithium demand is expected to be proportional to these projected EV sales figures.

The consensus among industry experts is that demand for lithium will grow significantly in the coming years due to increased penetration of electric vehicles (EVs) worldwide and the spread of renewable energy, resulting in increased demand and storage for batteries in a wide range of consumer products.

(2) Lithium price

Lithium price, a key raw material for batteries, is responding.

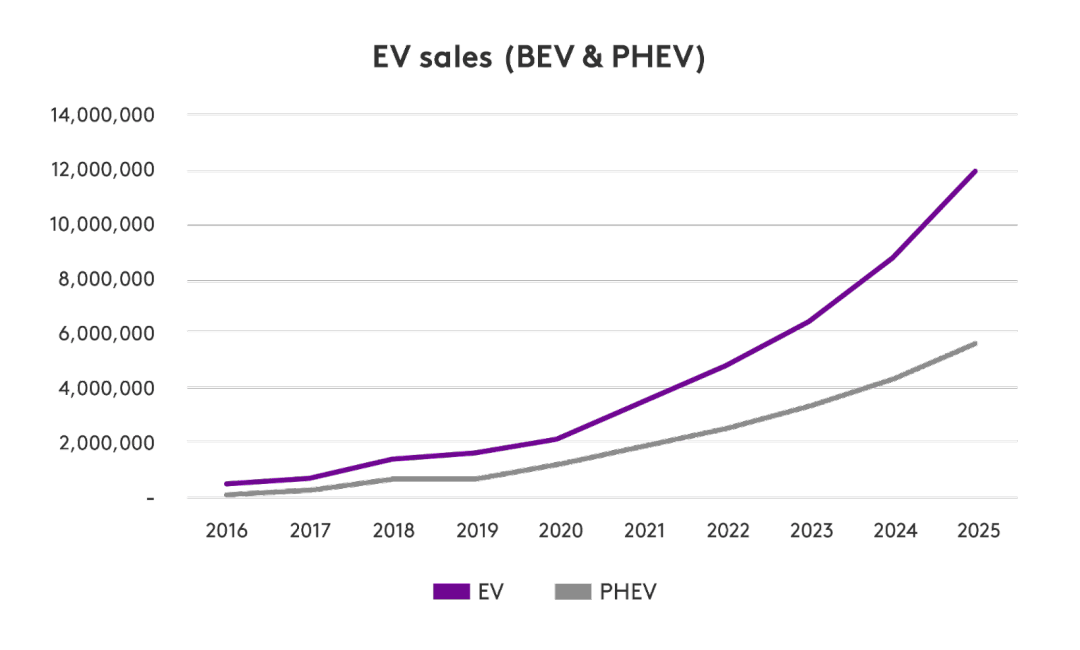

(Average Lithium Carbonate Price 2010-2021 (USD/metric ton))

As can be seen from the chart above, the average price of battery-grade lithium carbonate in 2021 is estimated at $17,000 per metric ton. Like 2018, this is the highest number in a decade.

(3) Lithium supply and demand

Technology-grade and battery-grade lithium carbonate prices will increase by 188.9% and 215%, respectively, in 2021. Most countries have already begun to chart a course to phase out fossil-fuel vehicles in favor of zero-emission vehicles, such as pure electric vehicles and fuel cell electric vehicles (FCEVs). While FCEVs will be powered by green hydrogen, which will require the use of large amounts of platinum in hydrogen proton exchange membrane fuel cells, battery-powered EVs will continue to use lithium batteries. Demand is expected to continue to rise as global automakers continue to introduce more electric vehicle models.

(4) Lithium supply and demand forecast

Looking ahead, lithium demand is expected to double in the second half of the century to more than 2 million tonnes by 2030. This growth will be primarily driven by demand for lithium-ion batteries for electric vehicles. Chinese demand is expected to remain the highest and will continue to account for half of global lithium-ion battery demand.

S&P is forecasting a 55% increase in global lithium production in 2022 compared to 2020, as the surge in demand is expected to continue.

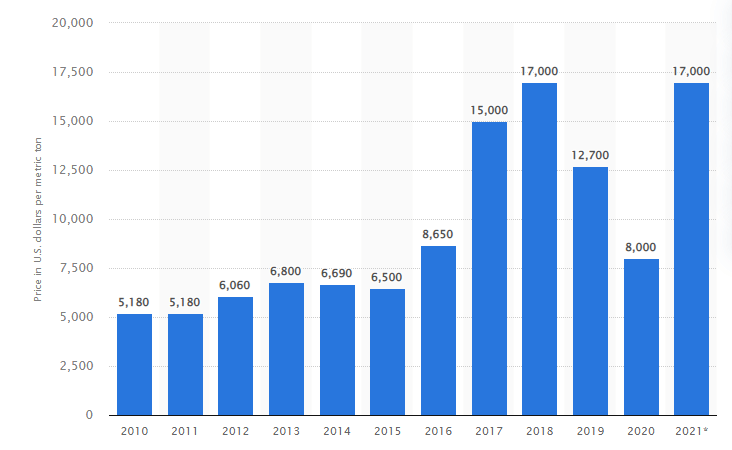

(Global Lithium Supply and Demand)

The world's challenge is to supply enough lithium to the market. Australia and Chile are the largest lithium exporters, and Afghanistan also has huge lithium reserves. However, North American OEMs may prefer a local source of the mineral, and it is unlikely that the current Afghan regime is organized enough to supply lithium to the global market.

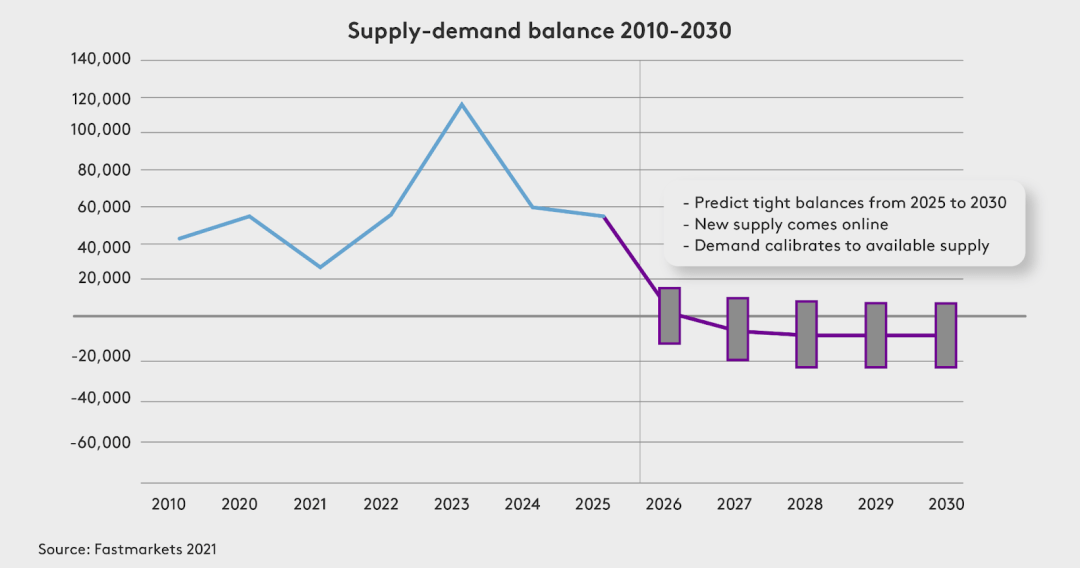

(Lithium supply and demand balance 2010-2030)

The graph above shows that supply-side shortages are expected to increase gradually through 2030. So, how will the market correct this supply shortage? In 2020, a total of 345,000 tons of lithium was produced and processed, mainly from the South American Lithium Triangle and Australia. Lithium production must quadruple between 2020 and 2030 to meet growing demand, from 345,000 tonnes in 2020 to 2 million tonnes in 2030. This will require new lithium production to come online to meet this demand.

+86 182 3440 3483

+86 182 3440 3483 yanzhang19990421@gmail.com

yanzhang19990421@gmail.com

Message

Message Chat Now

Chat Now