South African Mining Investment Guide

Chaya

Chaya

Jan 27, 2021

Jan 27, 2021

2503

2503

If you want to know more details about equipment, solutions, etc, please click the button below for free consultation, or leave your requirements!

South Africa is one of the most extensively mineralized countries of the world. It currently plays host to some of the world's major mining companies. Before we have talked about Phillipines mining investment guide. This article will introduce the mining investment environment in South Africa. Let's drive in it.

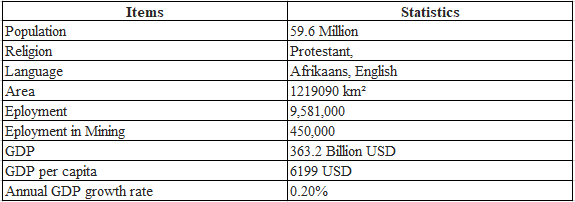

01 South African Fact Profile

BackThe Republic of South Africa, located at the southern tip of Africa, where the South Atlantic and the South Indian Ocean meet, is known as the "Rainbow Country". South Africa has an area of over 1.22 million square kilometers, ranking 24th in the world in terms of area and population, and a coastline of 2,798 kilometers.

South Africa is the 33rd largest economy in the world. As a developing country, it is one of the largest economies in Africa, and has the highest level of development and the most modern infrastructure in Africa. The financial and legal systems are relatively complete, and the infrastructure for communications, transportation, and energy is good. Mining, manufacturing, agriculture, and service industries are all well-developed and are the four pillars of the economy. Deep mining and other technologies are in a leading position in the world.

(Basic introduction of South Africa)

02 Distribution of Mineral Resources

BackSouth Africa is one of the most mineral-rich countries in the world, and it is also one of the world's five largest mineral resource countries. At present, the mining industry in South Africa has developed more than 70 kinds of minerals, and the mineral output accounts for about half of the entire Africa.

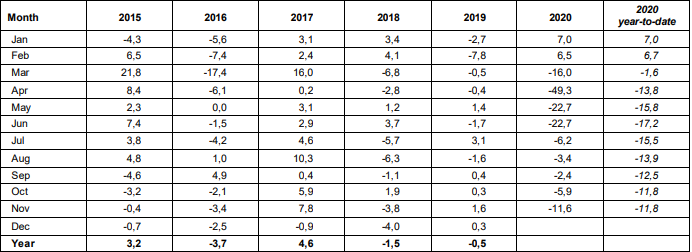

(Table1: Index of the volume of mining production (Base: 2015=100))

South Africa is the world's largest producer of platinum and chromium ore, which is mainly mined in Rustenburg and Steelpoort in the northeast. The output value accounts for a large proportion of the economy. Large deposits of platinum group and chromium ore are mainly located in the northern part of Pretoria. The Northern Cape has most of the major iron ore and manganese deposits, while titanium-bearing sands are common in the eastern coastal areas.

In addition, the country also produces uranium, palladium, nickel, copper, antimony, vanadium, fluorite and limestone. Historically, diamond mining has been focused around Kimberley and is now being carried out in many places.

South Africa is the world's largest producer of platinum and chromium ore, which is mainly mined in Rustenburg and Steelpoort in the northeast. The output value accounts for a large proportion of the economy. Large deposits of platinum group and chromium ore are mainly located in the northern part of Pretoria. The Northern Cape has most of the major iron ore and manganese deposits, while titanium-bearing sands are common in the eastern coastal areas.

In addition, the country also produces uranium, palladium, nickel, copper, antimony, vanadium, fluorite and limestone. Historically, diamond mining has been focused around Kimberley and is now being carried out in many places.

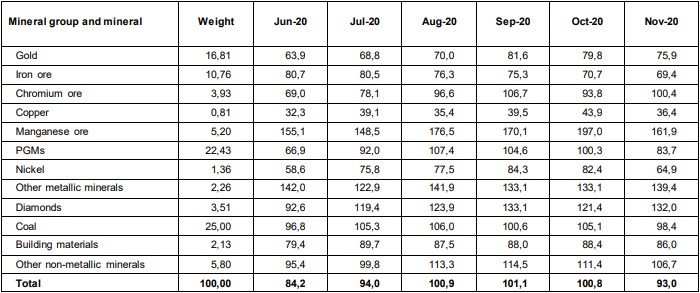

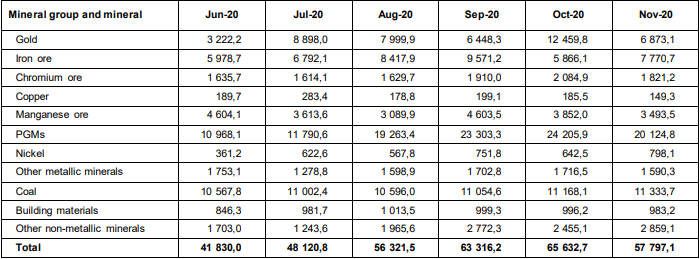

(Table2: Index of the volume of mining production by mineral group and mineral (Base: 2015=100))

Mining is one of the pillar industries of South Africa's national economy, and mineral resource exports account for 30% of South Africa's total exports. Mineral products are an important component of exports. In 2018, the export value of mineral products accounted for about 25% of total exports, and the output value accounted for about 7.3% of GDP.

South Africa's mining machinery, beneficiation technology and equipment, mine communication and safety assurance technology, mineral smelting and processing technology, and deep mining technology are among the best in the world.

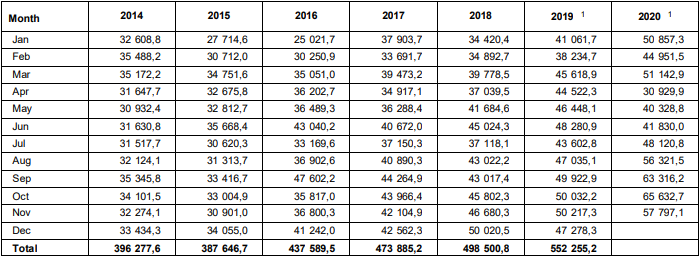

(Table3: Mineral sales at current prices (Rand million))

(Table4: Mineral sales at current prices by mineral group and mineral (R million))

03 Relevant Laws and Regulations

Back(1) Mining Permit

The South African Mining Law is regulated by the Mineral and Petroleum Resources Development Act No. 28 of 2002 ("MPRDA"), which is the main legislation involving acquisitions or rights in reconnaissance, prospecting and mining.

As far as MPRDA is concerned, the state is the keeper of all minerals. The Department of Mineral Resources and Energy (DMRE) has the right to grant, suspend and cancel mining and prospecting rights related to these minerals. DMRE is responsible for the management and enforcement of MPRDA through its national and regional official agencies. DMRE is also responsible for the management and enforcement of environmental regulations applicable to the mining industry.

Applicants must obtain a exploration permit from DMRE to conduct exploration operations. This type of license is valid for one year and cannot be transferred or renewed.

Before starting mining, the applicant must obtain the mining right or mining license and the environmental permit for the environmental authorization specified by NEMA. Mining rights can be granted for a maximum period of 30 years, and can be renewed, but cannot exceed 30 years.

In addition, the holder of the mining right must ensure that the designated mining area is properly zoned in accordance with the relevant regulations. Depending on the nature of the anticipated activity, the mining right holder may also need to obtain other permits, including water use permit, air emission permits or waste management permit.

(2) Ownership of Mineral Resources

South Africa’s mineral resources belong to the country, and the state acts as the keeper of mineral resources. MPRDA abolished private rights. Therefore, the landowners do not have the rights to any minerals found in their properties unless they apply to the state for exploration or mining of such rights. However, the landowners must first be consulted before granting mining rights in the affected areas.

Mineral property rights are usually granted to private groups and are obtained on a first-come, first-served basis, unless there is an existing priority.

04 Taxation

BackThe Mineral and Petroleum Resources Royalty Act (Royalty Act, 2008) requires the payment of royalties when transferring mineral resources mined from the territory of South Africa. The upper limit of the percentage of mining concession fees for refined mineral resources is 5%, and the percentage of unrefined mineral resources is 7%. Several double taxation agreements have been signed between South Africa and other countries in the world.

In addition to mining rights, South Africa, like all other countries, levies other taxes, such as income tax (corporate tax and personal tax), capital gains tax and transaction tax, such as value-added tax, securities transfer tax and transfer tax.

Mining companies in South Africa (except gold mining companies) are taxed at a corporate income tax rate of 28%, which is calculated based on the marginal tax rate, the proportion of tax-free income and the proportion of taxable income to total income.

If the mining company's investment is high, the South African government will give additional allowances and allow mining companies to carry over the unused capital expenditure balance in a tax year to offset mining income.

05 Investment Prospects

BackSouth Africa promulgated the Investment Protection Act (PIA) No. 22 of 2015, which aims to ensure that foreign investors and domestic investors in South Africa are treated equally in accordance with the law. According to these regulations, foreign investors in the host country generally enjoys Fair and Equitabe Treatent (ET), National Treatment (NT), Most-Favored-Nation Teatrment (MFN), and full security and protection.

South Africa promulgated the Investment Protection Act (PIA) No. 22 of 2015, which aims to ensure that foreign investors and domestic investors in South Africa are treated equally in accordance with the law. According to these regulations, foreign investors in the host country generally enjoys Fair and Equitabe Treatent (ET), National Treatment (NT), Most-Favored-Nation Teatrment (MFN), and full security and protection.

Andries Rossouw, PwC Africa energy utilities and resources leader, said: “South Africa’s mining sector continues to be a meaningful contributor to the economy and has weathered the COVID-19 pandemic in many respects-showing good profitability and retaining strong balance sheets.

06 Overall Investment Environment

Back(1) Favorable Factors

First, South Africa is rich in mineral resources, rich in labor resources, complete in infrastructure, and has certain scientific research and innovative capabilities. It is the base for manufacturing and service outsourcing in Africa.

Second, South Africa is politically and economically stable. To promote investment and economic growth, South African government has issued a series of policies, measures and plans to encourage investment.

Third, South Africa has a sound financial and legal system. The financial industry is developed, and third-party professional services such as law firms and accounting firms are strong.

(2) Unfavorable Factors

First, the labor relations in South Africa are tense, labor unions are strong, and strikes are frequent.

Second, South African currency Rand has a high degree of correlation with major currencies such as US Dollar and Euro, its exchange rate fluctuations are large.

Third, South Africa’s social conflicts are relatively large, with social problems such as a wide gap between the rich and the poor, high unemployment and crime rates, and many illegal immigrants.

Fourth, South Africa lacks high-quality labor, and wage growth is much faster than economic growth, which raises the operating costs of enterprises and weakens the international competitiveness of the manufacturing industry.

Fifth, the development of South Africa is uneven, and the dual economic characteristics of urban and rural areas, black and white are obvious.

07To Sum Up

BackAlthough South Africa is rich in mineral resources and there are many mineral development projects, it is necessary to do a good job of preliminary research to invest in mining in South Africa.

This article is intended to provide a reference for readers to make decisions, and does not make direct suggestions.

+86 182 3440 3483

+86 182 3440 3483 yanzhang19990421@gmail.com

yanzhang19990421@gmail.com

Message

Message Chat Now

Chat Now